One Stop Logistics Service Provider

To provide on time delivery and exceptional customer service with every load we haul

Responsive, Dedicated & Optimized Full Logistics Service Provider

NGL Transportation is a full logistics service provider that has been in business since 2006. It is now assisting global companies who need freight forwarding, warehousing/distribution, drayage/trucking and special project services.

ngl transportation

Premium deliveries anywhere in the US

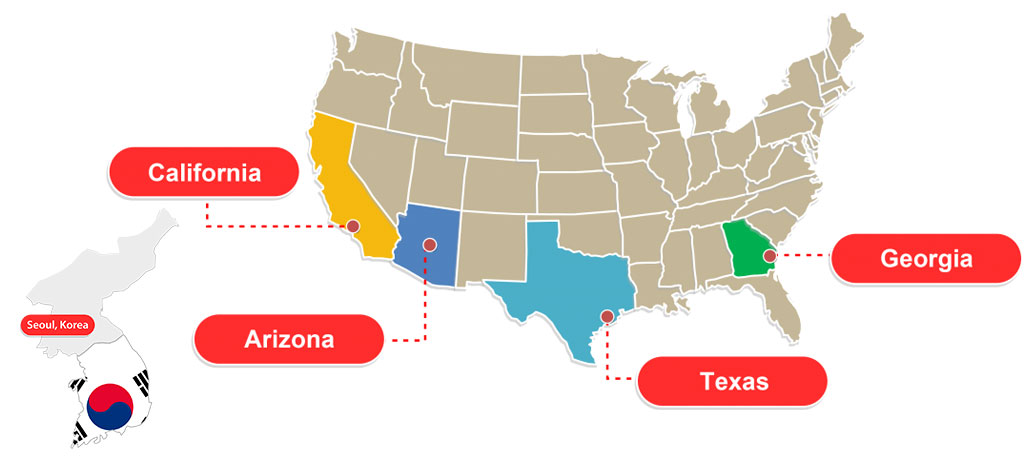

NGL Transporation is your full logistics service partner with a fleet of over 200 trucks and 500 chassis with flip services, fully equiped warehouse and multi container yards in CA, AZ and TX. Big or small we will handle your global business with a dedicated sevice and response.

ngl transportation

Premium deliveries anywhere in the US

NGL Transporation is your full logistics service partner with a fleet of over 300+ trucks and 1000+ chassis with flip services, fully equiped warehouse and multi container yards in CA, AZ, TX and GA. Big or small we will handle your global business with a dedicated sevice and response.

OUR SERVICES

trucking

Our variety of trucking services allows you to select the carrier and transit time desired for each shipment. Our expert team will proactively track, communicate, and resolve every issue every step of the way.

trucking (Drayage, Over The Road)

We proudly utilize Al-enabled TMS to provide realtime monitoring, predictive risk mitigation and 24/7 dedicated team for issue resolution at every step of the process.

Heavy, Oversize & Hazmat

We manage everything from start to finish, including in-house special permit & escorting service, risk-free route designing, and logistics cost minimization with our own people and equipment.

Warehousing & Trans-loading

We provide a full range of leading-edge warehousing and trans-loading services through NGL’s own WMS and warehouses & yards located across the US major ports.

Warehousing & Trans-loading

We provide a full range of leading edge warehousing and fulfillment capabilities designed for all industries to reduce logistics, minimize transportation and inventory costs while sharing resources.

E-COMMERCE

Our e-Commerce team ensures the best fulfillment process, value-added services, and tailored supply chain management for each and every customer while seamlessly bridging in between manufacturers and end users.

WHAT’s NEW

Hurricane Milton Update: Port Closures

Hurricane Milton has made landfall, leading to the closure of several key...

Navigating Port Strike Disruptions: NGL is Here for You

Hello from the NGL Brand Marketing Team. The recent three-day strike by the...

Tentative Agreement Ends Dockworker Strike

The International Longshoremen's Association (ILA) and the U.S. Maritime...

Important Update: Upcoming Dockworker Strike Preparations

The International Longshoremen’s Association (ILA) has set a strike date for...

Important Update for Shipping Partners

With a potential strike at the Port of New York-New Jersey scheduled for...

WHAT’s NEW

Hurricane Milton Update: Port Closures

Hurricane Milton has made landfall, leading to the closure of several key...

Navigating Port Strike Disruptions: NGL is Here for You

Hello from the NGL Brand Marketing Team. The recent three-day strike by the...

Tentative Agreement Ends Dockworker Strike

The International Longshoremen's Association (ILA) and the U.S. Maritime...

Important Update: Upcoming Dockworker Strike Preparations

The International Longshoremen’s Association (ILA) has set a strike date for...

Important Update for Shipping Partners

With a potential strike at the Port of New York-New Jersey scheduled for...

OUR CUSTOMERS

NGL SUPPORT

We're here to support you. If you need a quotation or want to track your shipment, please contact us.

Arizona (HQ)

(623) 930-0932

California (Gardena)

(310) 595-6752

CAlifornia (Riverside)

(951) 346-5465

Texas

(281) 864-7028

Georgia

(912) 239-4500

Seoul, Korea (Asia HQ)